With the Global Citizen Card, users will easily make transactions, access financial services, and have their rights and assets protected and secure in the global cryptocurrency ecosystem.

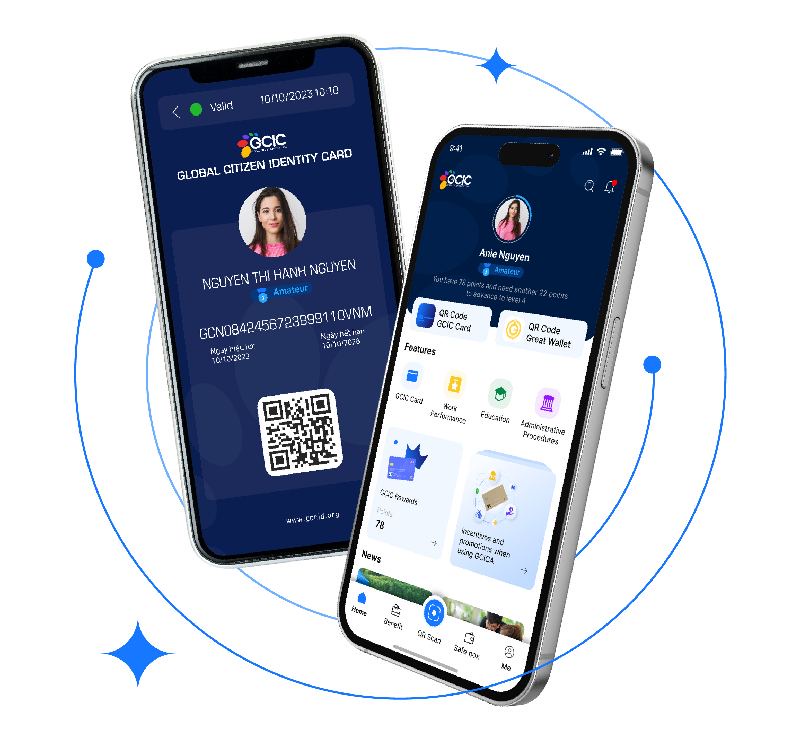

Global Citizenship Card (GCIC) Application

Card payment market in Vietnam

The card payment market in Vietnam is currently in a period of strong development with great potential. According to the State Bank of Vietnam, the number of payment cards will reach more than 100 million by 2023, including credit cards, debit cards and prepaid cards. However, credit cards still account for a low proportion, mainly due to people's consumption habits and limitations in personal credit.

The development of mobile payment applications such as MoMo, ZaloPay and ViettelPay has created a breakthrough in promoting cashless payments in Vietnam. However, the biggest challenge now is how to popularize card payments in rural and mountainous areas where banking and technological infrastructure are not yet complete.

Despite the rapid increase in the number of cards and users, the rate of card usage for payment at the point of sale (POS) remains low. The main reasons are security concerns, cash usage habits and limitations in installing card payment acceptance systems at small retail stores.

International card payment market

Globally, card payments have become an integral part of the digital economy. In developed countries such as the US, Canada, and Europe, card payments account for a large proportion of total consumer transactions. In addition, contactless payment technologies such as Apple Pay, Google Pay, and Samsung Pay have changed the way consumers approach cashless payments, creating maximum convenience.

The international market today does not stop at physical cards, but also expands to smarter payment methods such as QR codes, e-wallets, and virtual cards. This shows a clear trend in shifting to digital payment methods, towards a cashless society.

Blockchain and Currency Security

Monetary security is not simply about controlling the money supply, but also about ensuring the stability of the financial system and preventing illegal activities such as money laundering and terrorist financing. With the advent of cryptocurrencies and decentralized payment systems, the challenge of ensuring monetary security has become even more complex.

Central banks and government regulators need to have tools to monitor and control money flows, especially in the area of cryptocurrencies and cross-border transactions. This requires international cooperation and the development of strict regulations on digital currency management.

In addition, blockchain technology can also play an important role in ensuring transparency and security of currency. By using distributed ledger technology, every transaction can be recorded publicly and cannot be edited, helping to prevent fraud and money laundering.

Security on cashless apps

Security on cashless payment applications is vital to protect users’ rights and ensure the safety of the financial system. Major security threats today include online fraud (phishing), malware (malware), DDoS attacks, and breach attacks.

To enhance security, cashless applications need to integrate technological solutions such as: Biometric authentication: Using fingerprints, facial recognition or voice to authenticate users; Tokenization: Replacing sensitive user information with a unique identifier (token), helping to prevent data theft; End-to-End Encryption: Ensuring that information can only be decrypted by the recipient, not revealed during transmission; AI and Machine Learning: Applying artificial intelligence models to quickly detect and prevent abnormal behaviors or potential threats.

Solutions for developing cashless payments in Vietnam

Payment infrastructure development: It is necessary to invest in payment acceptance infrastructure such as POS machines, QR codes at points of sale, especially in rural areas. The government and banks need to have programs to support and encourage the installation of this payment system.

Encourage the use of cashless payments: Governments can introduce discounts and cashback programs for cashless payments, especially in areas such as education, healthcare and public transport.

Building trust and awareness: Increase propaganda and dissemination of the benefits of cashless payments, ensuring safety and security so that people gradually change their cash-using habits.

Cross-industry cooperation: Coordination between banks, financial institutions, and network operators in providing integrated digital financial products, giving users more choices and convenience in transactions.

Support the development of mobile payment applications: Promote the deployment of mobile payment solutions such as e-wallets, QR code payments and other mobile payment solutions to create a comprehensive payment ecosystem.

GCN Blockchain – Great Wallet

Great Crypto: the core cryptocurrency of the system, built on the foundation of the basic labor theory of value and blockchain technology. This currency not only brings a new means of payment but also creates fairness and transparency for all transactions globally.

Dr. Vo Xuan Truong said: “ GCN Blockchain will help promote job opportunities and promote growth for the world economy in a sustainable and strong way through recording the transparency of transactions and transaction values, while creating more jobs through the Smart Contract function and Dapps (Decentralized Applications) for each individual to create new jobs and call for cooperation, from passively applying for jobs according to the salary set by the employer, workers proactively create projects for themselves according to the needs of the world economy to attract people with the same passion or need to work on the basis of equality and transparency of smart contracts in the sharing economy and circular economy.”

Global Citizenship Card

Global Citizen Identity Card: To ensure transparency and legitimacy in the system, the Global Citizen Identity Card will be used as a KYC (Know Your Customer) identity authentication tool for all Great Wallet accounts.

The Global Citizen Card (GCIC) is a globally recognized unified identity verification system that ensures individuals can access digital services across borders. GCIC provides a technological framework for KYC (Know Your Customer) compliance, security, and borderless financial transactions. The card fosters a global network of citizens who can engage in activities such as travel, work, and financial exchange with great convenience.

Nguyen Nam